Apartment List

Audio By Carbonatix

Princeton University sociologist Matthew Desmond has called the mortgage-interest tax deduction — which lets property owners cut up to $1 million off their tax bill — an “engine of American inequality.” The Atlantic once labeled the policy “a symbol of everything that’s wrong with the American tax code.”

And a study released yesterday by the website Apartment List shows exactly why that is: Rich Miami residents receive 75 percent more federal housing assistance than poor people do thanks to the rule. The study shows that wealthy real-estate owners suck far more money out of the government thanks to mortgage-interest deductions than poor people receive through federal Section 8 housing assistance. Apartment List researchers determined that more than half of the federal housing assistance in Miami is spent helping people in the highest income bracket, as opposed to the lowest.

“In 2015, the mortgage-interest deduction (MID) cost the federal government $71 billion, more than double the $29.9 billion funding for Section 8,” Apartment List’s researchers wrote. “Additionally, the MID is a highly regressive benefit, with 85 percent of expenditure going to high-income households.”

The mortgage-interest deduction is simple in scope: The federal government lets you deduct any interest you pay on your mortgage from your taxes. But in reality, it benefits only the wealthy. According to the Atlantic, 90 percent of the $71 billion the federal government gave back through mortgage deductions went to people earning $100,000 a year or more. That’s because the value of your mortgage deduction rises along with the value of your mortgage — 5 percent interest on a $5 million home amounts to much more money than a 5 percent cut of a $50,000 property. The policy doles out more money to people who can afford huge homes.

Scores of economists have complained about the deduction over the years because in addition to simply rewarding rich people, the policy inflates housing prices for everyone else because it lets people save money after taxes if they take on more debt. In other words: The rule makes it easier to afford even more expensive real estate. One 1996 study the New York Times cited suggests that MID policies inflate housing prices by 13 to 17 percent nationally.

If you can afford a home, the policy is great. But for the millions of people who can’t, it makes breaking into the housing market that much more difficult. As of 2012, only one-fourth of U.S. taxpayers claimed the benefits. Those people tend to manage their money well or earn enough to pay financial advisers. The deduction was designed to help people buy homes who would otherwise rent them, but one economist told USA Today in 2012 that the policy instead encourages wealthy people to buy bigger.

In the meantime, Section 8 housing rules for the poor are much simpler. You just apply for assistance if your wages are low enough. But Apartment List says only 11 percent of low-income homeowners receive federal assistance.

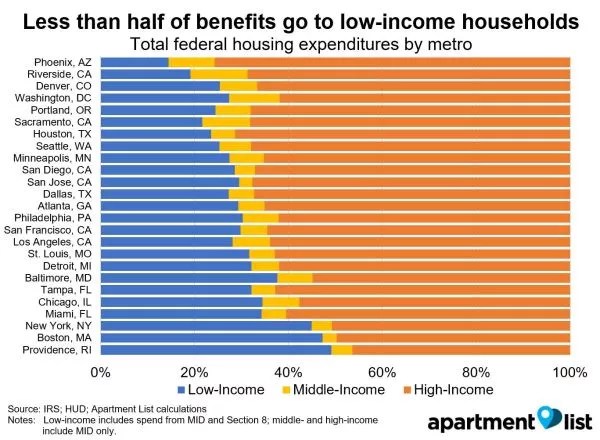

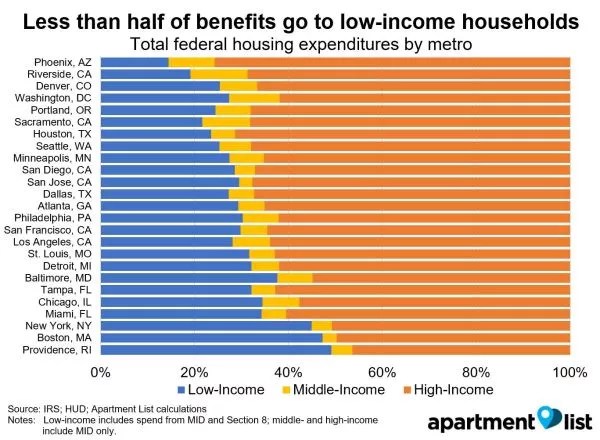

Yesterday, Apartment List churned through city-by-city Section 8 and MID data and found that zero of the 25 largest metropolitan areas in America spend more than half their housing assistance on poor people. None. Miami actually ranked fourth-best on that list, but no city should want to be on the list at all.

According to the data, roughly 60 percent of the money the federal government spends in Miami goes toward helping the highest earners buy homes:

Apartment List

(The chart also makes clear that the federal government has no clue what it’s doing when it comes to middle-income earners, who get just a tiny percentage of the pie.)

Apartment List released its study to coincide with Donald Trump and congressional Republicans’ attempts to “streamline” the U.S. tax code. Analysts say those plans will mostly cut taxes for rich people, and most tax experts say Trump’s plan to “fix” the mortgage-interest system doesn’t fix much at all. In fact, Apartment List says the MID would only help rich people more under the Trump plan.

“The initial version of the Trump tax plan keeps the MID in place, but by doubling the standard deduction, reduces the number of households that will benefit from claiming the deduction,” the website noted. “This would reduce the total amount of expenditure on the MID, but would actually make the benefit even more regressive.”

Analyses from the websites Zillow and Trulia also made similar points: Homeowners with $300,000 mortgages likely wouldn’t receive a deduction under Trump’s plan, and fewer people overall would probably be able to qualify for MID benefits. But an even wealthier set of people — those with $600,000 to $800,000 homes — would qualify for rebate checks and housing assistance. (Trump claims middle and low earners would make more money back in tax breaks elsewhere, but that’s currently unclear.) Plus, Trump’s own administration is fighting him on that idea: Treasury Secretary Steve Mnuchin has said repeatedly he favors “leaving the mortgage-interest deduction as is.”

In the meantime, few cities could use federal housing help more than Miami: According to federal data, Miamians spend the nation’s highest share of their incomes on rent. As New Times has covered extensively, Miami is one of the most difficult places in America to live if you’re poor.

But in light of the fact that Mnuchin made boatloads of money foreclosing people’s homes — and that Housing and Urban Development Secretary Ben Carson, who oversees the Section 8 program, has plunged HUD into an “existential crisis,” according to ProPublica — rent-squeezed Magic City residents shouldn’t exactly feel hopeful about the Trump administration fixing any of this mess by 2020.