StatFunding

Audio By Carbonatix

It’s really difficult to be the bearer of more bad news this week. Progressives have woken up every day this week in a state of panic, crawling out of bed to check their news feeds, only to get the wind knocked out of them upon reading President Trump’s newest slate of racist executive orders that seem all but designed to stir global unrest and disaster.

Trump is certainly a threat to Miami. But according to a study released yesterday, so is the city’s condo market.

The study, by Andrew Stearns, a real-estate analyst who runs the website StatFunding.com, paints a bleak picture for Miami’s condo market. Stears for months has warned that the massive glut of new condo buildings coming to market could hedge into anything from a brief period of “correction” to a full-on real-estate crisis in the next few years.

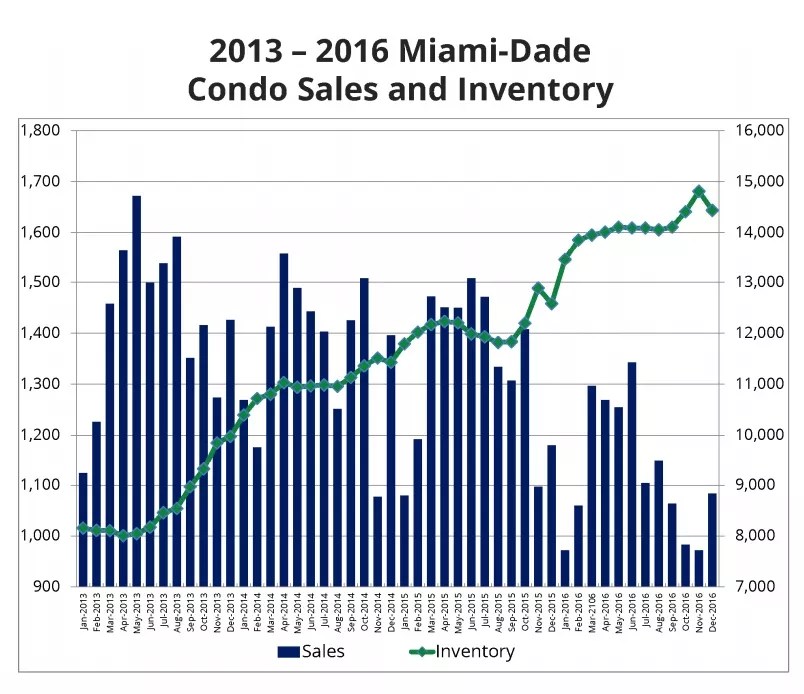

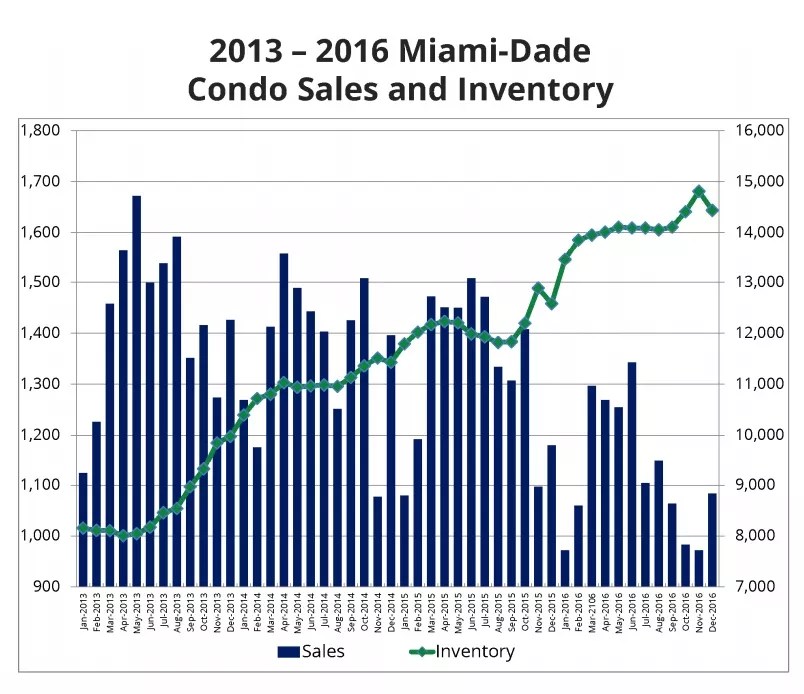

His latest study presents new evidence to back up his dire predictions: New, “preconstruction” condo sales are plummeting, he reports, just as inventory is reaching its all-time peak.

In September, Stearns told New Times that 3,000 condo units came to market in the past four years — and despite the fact that most of those units haven’t sold, developers are building a mind-numbing 11,000 more units by 2018. The results are already becoming clear: There’s too much supply and not nearly enough demand.

StatFunding

“Developers are getting stuck with unsold units at a time when overall condo inventories have built to over 13 months of supply at current sales rates,” he writes.

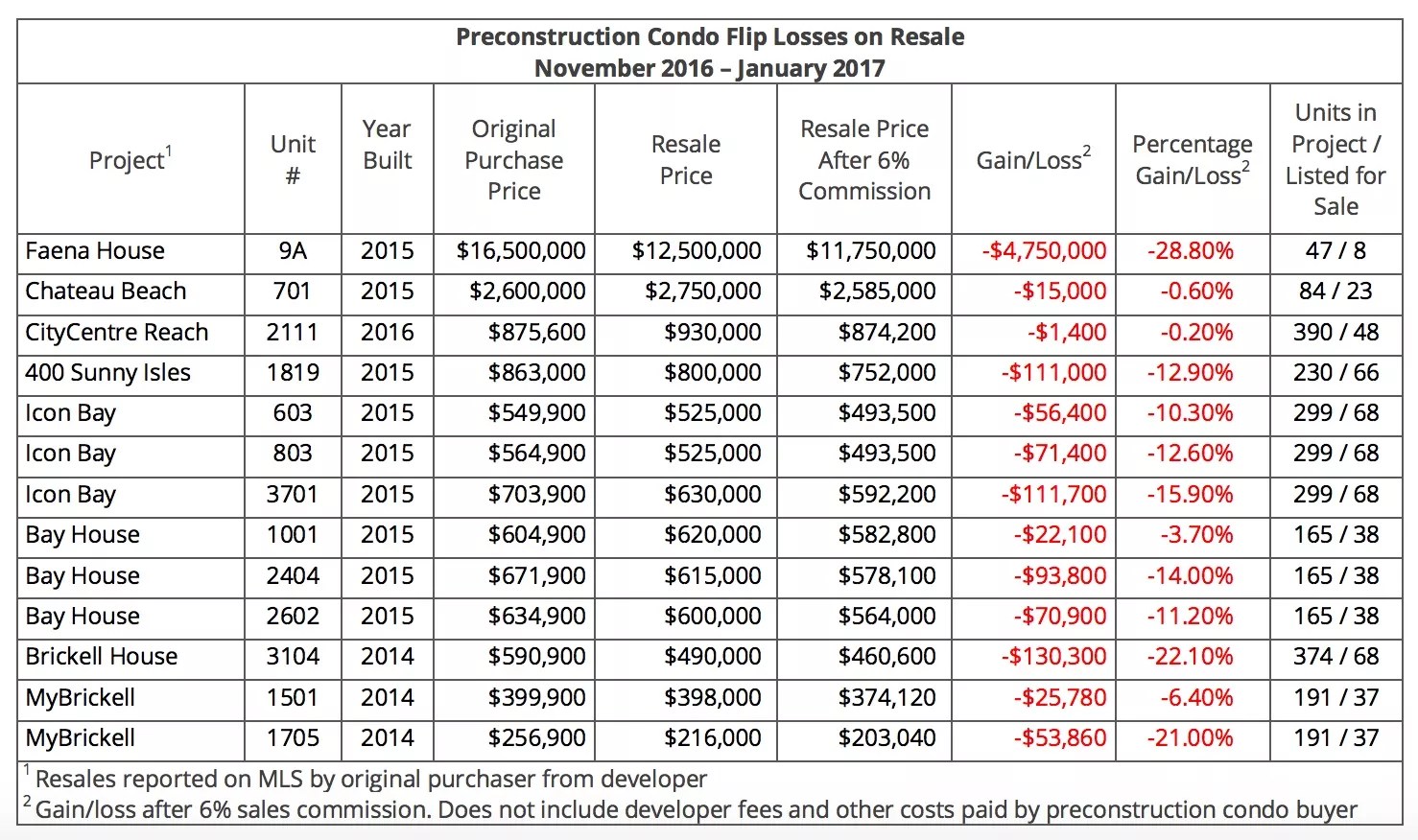

In the resale market, just 13 new condos were “flipped” from November through January — and all of them lost money. One home-flipper at the ultra-luxury Faena House in Miami Beach lost $4.75 million after reselling a unit built in 2015. In addition, more than 70 units are listed as “underwater” — AKA their mortgages cost more than the homes are worth — and with such a glut of condos available, basically nobody is willing to lose money on an underwater investment.

StatFunding

Miami real estate is typically propped up by foreign investors, but the surging U.S. dollar is likely discouraging Russian and Latin American buyers from shoveling money into the city like they had during the housing crisis.

“Because there are so many listings-for-losses in the market, comparable sales prices are trending down,

inventories are already at staggering levels, and thousands of new condo units will hit the market in 2017

and 2018, Miami condo flippers should expect losses on resale to continue,” Stearns writes.

In addition, buildings aren’t selling out nearly as fast as they used to. From 2012 to 2015, entire buildings typically sold out within months. But now, at least nine buildings that opened in 2015 and 2016 still have unsold units — including Brickell’s Rise, which opened in September and is still about half vacant.

“The Miami pre-construction condo resale market appears to be distressed,” Stearns writes. “As an additional 10,000+ units are completed and subsets of those units are then listed for resale over the next 24 months, the pre-construction condo resale market will likely continue to weaken. Unless something extremely positive and unexpected occurs which completely changes market conditions, Miami condo flippers should expect further losses on resale in the immediate future.”

In case all of that wasn’t worrying enough, the Miami Herald reported earlier this week that the city’s luxury real-estate market is taking a beating too. The culprit is the same: oversupply.