Audio By Carbonatix

Miami’s cost of living remains relatively similar to that of

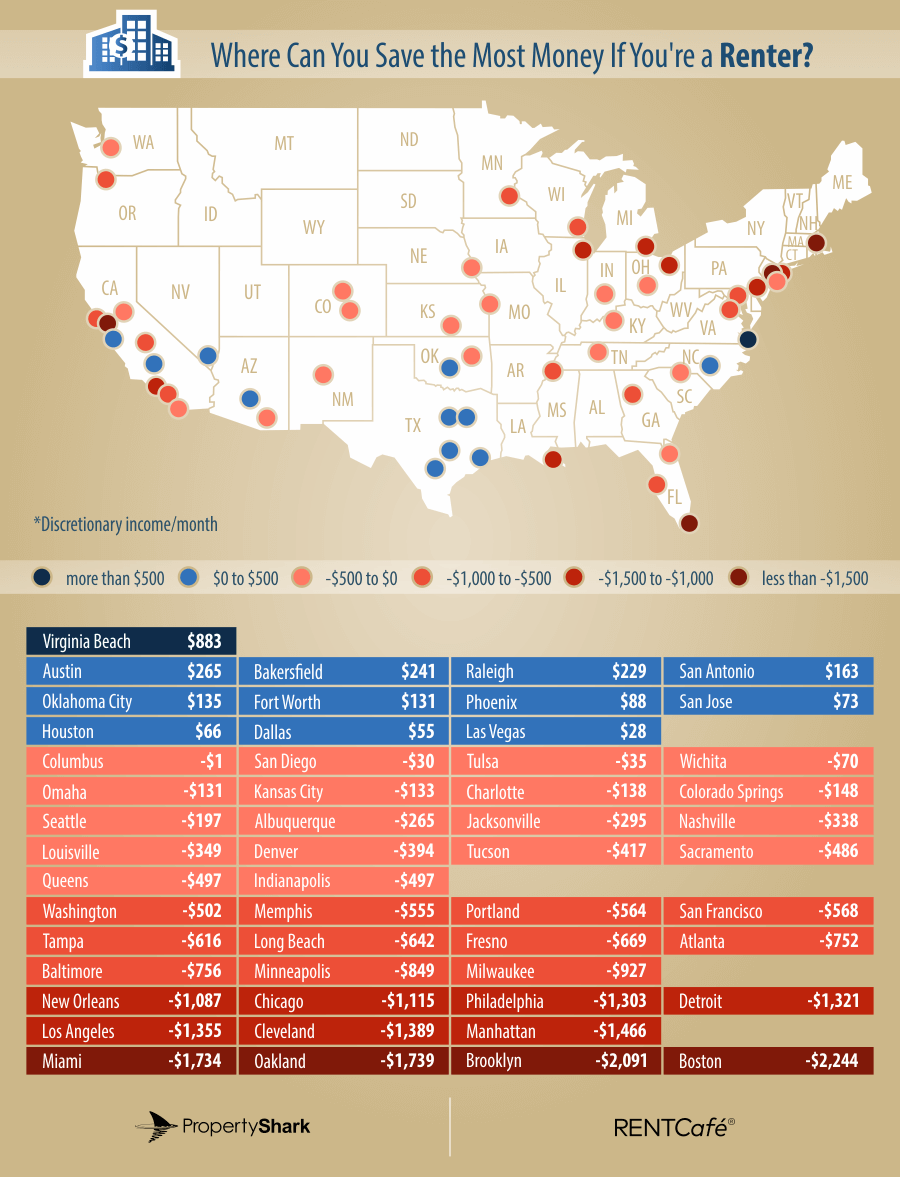

So it’s no surprise that Miamians’ savings accounts are being ground into dust. Case in point: A new study released yesterday by the real-estate analysis websites RentCafé and PropertyShark shows that, among people who rent apartments, Miami is the fourth-hardest city in America to save money.

And among homeowners, the websites found that Miami is the single toughest area in the nation to save money. Wheeee!

“Miami sits at the bottom of the list, with very low median [monthly] household income ($4,241) compared to similar cities and living costs exceeding $4,274,” the study notes. “Adding housing costs to the mix ($1,186), monthly expenditures leave the average Miami homeowner with a debt of $1,219 each month. With living costs already higher than the median income, you’d have to drastically cut your expenses to afford

In compiling the study, RentCafé and PropertyShark combined monthly living-cost data from the U.S. Bureau of Labor Statistics with crowdsourced cost-of-living data from the website Numbeo. (Because Numbeo’s data is crowdsourced, you should probably take it with a grain of salt.) The researchers basically subtracted monthly housing and living costs (food, transportation, etc.) from a given city’s median monthly income.

From there, analysts split the data for renters and homeowners. Some cities fluctuated wildly: If you can afford to own a home in Manhattan, San Jose, D.C., Seattle, or San Francisco, you can allegedly save a bunch of money because median household incomes in those cities remain pretty high thanks to their high-paying finance, business, and tech industries.

As the study notes, monthly

The monthly savings problem becomes really acute when you conduct the same calculation for renters: Cities such as New York and San Francisco rightfully plummet to the bottom of the list alongside Miami. The Magic City comes in fourth-worst, behind Boston, Brooklyn, and Oakland. Cities with cheap rent dominated this list. If you want to save money as a renter, you’ll have an easier time in Virginia Beach than Los Angeles.

RentCaf

So there you have it: another study showing how ridiculously hard Miamians are getting squeezed. Excuse us while we go scream into a pillow.