Photo by Roman Boed / Flickr

Audio By Carbonatix

Last year, the Miami-Dade County Commission shot down a plan that would have forced local developers to include some affordable apartments in every new project. Commissioner Javier Souto claimed the idea was “social engineering,” one of the most profoundly stupid things said in South Florida politics this decade.

A federal study released last week confirms, yet again, that Miami’s political class is letting this extremely expensive city run roughshod over its poor residents: The U.S. Department of Housing and Urban Development shows Miami has the nation’s highest percentage of poor renters with “worst-case needs.” In other words: Miami’s poorest renters are squeezed harder than residents of any other city.

According to the study, almost two-thirds of Miami’s poor are stuck spending more than half of their income on rent or living in roach-infested hellholes.

“These households are defined as very low-income renters who do not receive government housing assistance and who paid more than one-half of their income for rent, lived in severely inadequate conditions, or both,” HUD’s researchers write. “High rents in proportion to renter incomes remain dominant among households with worst-case needs, leaving these renters with substantial, unmet need for affordable housing.”

Larger cities, including New York, Los Angeles, and Chicago, technically have higher total numbers of worst-case renters. But the worst-off renters in those cities make up a smaller slice of the total than those in Miami. The Magic City does a uniquely terrible job of taking care of its poor: A full 60.9 percent of the city’s very low-income renters are living under “worst-case” scenarios, according to the feds. No other city cracked that 60 percent mark. Los Angeles came in at a distant second, with 54.5 percent of low-income renters living in nightmarish conditions.

In terms of pure numbers, New York has 815,000 “worst-case” residents, L.A. contains 567,000, Chicago has 242,000, and Miami landed in fourth with 227,000. But the fact that Miami is fourth in total numbers is insane: Those first three cities are the first, second, and third most populous areas in America. The Miami/Fort Lauderdale metro area, meanwhile, is the eighth-largest metro area in the nation but somehow contains the fourth-highest number of massively burdened residents.

It’s one thing when amateur real-estate analysts at sites such as Zillow and RentCafe claim Miami’s housing market is unaffordable, but it’s another when federal data says so. HUD analyzed stats from 2013 to 2015. In that period, any income increases the nation’s poor saw were eclipsed by rises in rent, especially in urban areas.

“Growing incomes of renter households accompanied a substantial increase in the number of renter households, but, unfortunately, income increases were insufficient to prevent growth in the number classified as having very low incomes,” the study says. “Even as the overall supply of rental units expanded, rents increased and the shortage of affordable and available units for extremely low-income renters and very low-income renters became more severe.”

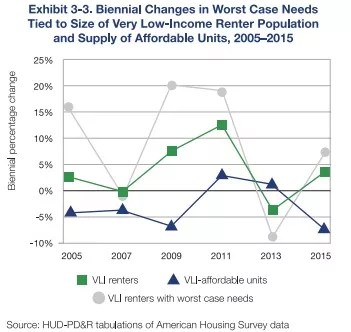

Nationally, the percentage of very low-income and worst-case-scenario renters spiked in the past two years, rising to rates not seen since the peak of the housing crisis:

HUD

“With few exceptions, the number of households experiencing worst-case needs has increased steadily, with the sharpest increases observed during and immediately following the recessionary period,” the study says.

The findings match up with the dire statistics the U.S. Census Bureau released earlier this year: In January, American Community Survey data revealed Miamians spend the nation’s highest share of income on rent. Miami is trapped in a major bind: Thanks to a draconian, pro-big-business state law, Florida’s cities are barred from setting their own minimum wages, thus ensuring that Miami’s poorest workers are paid a useless $8.15 an hour, the same as workers living in the rural Yeehaw Junction. There’s also a debate as to whether increasing the minimum wage would help people afford rent or if a wage increase would also simply encourage landlords to raise rents.

There is another option: Cities have the power to force builders to create rental units for low- and middle-income residents. Miami-Dade’s city councils have failed to do so and have instead tried to rely on plans that give zoning benefits to builders for voluntarily making their apartments affordable. An April study from the Urban

Much of the blame falls on Tallahassee: Mandatory affordable-housing rules are difficult to enforce without state or federal subsidies. The Florida Legislature long ago set up a trust fund to help subsidize housing across the state, but for ten straight years, state lawmakers have funneled that money into random projects that have nothing to do with housing.

According to the Miami Herald, $1.3 billion has been siphoned out of the fund since the Great Recession.