Photo by Aurimas / Flickr

Audio By Carbonatix

By nearly every metric, Miami’s housing and rental markets are Kafkaesque nightmares. Few people can afford their homes here because they are expensive, while median incomes are embarrassingly low. It’s a dangerous predicament — one natural disaster could throw tons of cash-strapped homeowners spiraling into bankruptcy.

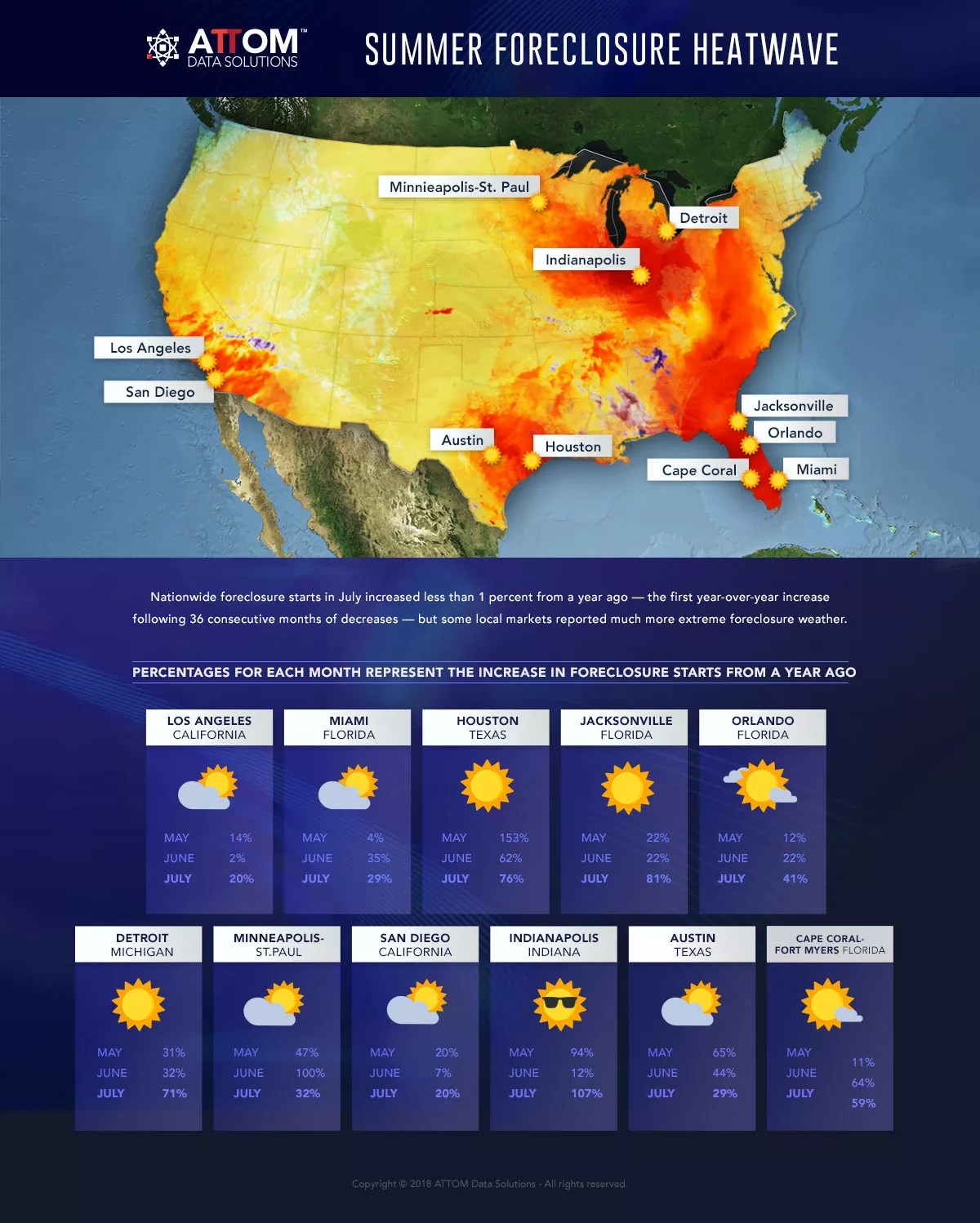

Well, according to a new report from Attom Data Solutions, the Magic City is now dealing with the fallout from one of those disasters: Foreclosures in Miami spiked 29 percent from July 2017 to July 2018, and Hurricane Irma is partly to blame.

For the first time in three years, home foreclosures actually rose year-over-year across America during the past 12 months. According to a new report released today, Miami is, ahem, not one of the few U.S. cities that have fared well over the past year — the city saw 1,119 new foreclosures in the past month alone. Though some of that spike can be attributed to damage from Hurricane Irma in September 2017, Attom’s analysts warn the foreclosure spike could be a sign of greater trouble on the horizon.

Statewide, Florida saw 35 percent more foreclosure filings this month than in July 2017 — the largest single-state spike in America.

“The increase in foreclosure starts is not just a one-month anomaly in many local markets given that July represented the third consecutive month with a year-over-year increase in 33 metro areas, including Los Angeles, Miami, Houston, Detroit, San Diego, and Austin,” Attom Senior Vice President Daren Blomquist said today in a release. “Gradually loosening lending standards over the past few years have introduced a modicum of risk back into the housing market, and that additional risk is resulting in rising foreclosure starts in a diverse set of markets.”

While the national housing market appears ripe for a rise in foreclosures overall, the report warns that cities hit with natural disasters in the past year are doing worse the others. Take, for instance, Houston, which lived through nightmarish flooding thanks to Hurricane Harvey: Foreclosures are up 76 percent year-over-year in that city.

Florida cities that weathered Irma’s worst are faring poorly too. Cape Coral saw a 59 percent foreclosure jump over the past 12 months.

Overall, Atlantic City, a town trapped in an ongoing financial meltdown, listed the highest foreclosure rate of the 219 largest cities in America. (Trenton and Philadelphia also hit the top five.) In contrast, New York City saw a 16 percent drop in new cases.

Attom Data Solutions

“Most susceptible to rising foreclosure starts are affordability-challenged markets where homebuyers are more financially stretched and markets with some type of trigger event, such as a natural disaster or large-scale layoffs,” Attom’s Bloomquist said today.

The Miami Herald reported in January that Irma-related damage was forcing money-stretched homeowners into foreclosure — but thanks to the city’s absurd housing market, where locals have no money but outside investors continue to inflate real-estate prices, it appears homeowners are still struggling nearly a year after the storm.