Photo by travelview / iStock

Audio By Carbonatix

The nation’s unemployment rate is low and the stock market is high. Considering only those simple benchmarks, you’d think life was pretty great in America in 2019.

Miami, where unemployment is at a near-record low, should also be living well.

But dig a little deeper, and you’ll find tons of data explaining why Miami’s low and middle earners still feel as if they’re being ground into dust by the nation’s economic system. Today the United Way released its annual ALICE report – a document that catalogs how many Americans are working but not making enough to live healthy, full lives.

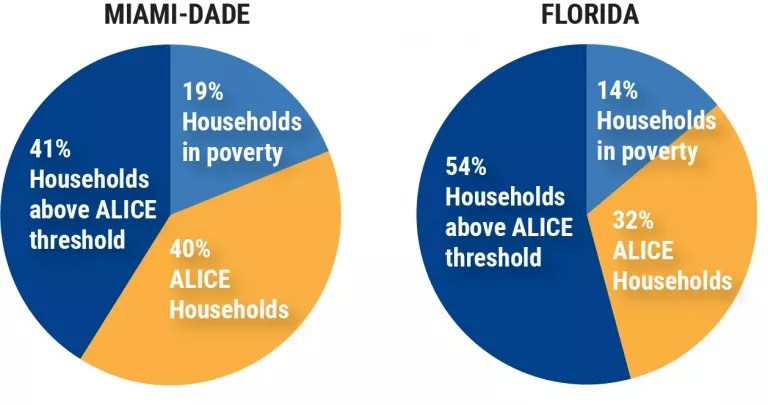

ALICE is an acronym for “Asset Limited, Income Constrained, Employed” – more simply put, the working poor. Forty percent of Miami-Dade County’s 2.7 million residents qualified for this group in 2016, the year studied, according to the United Way’s report. (That’s 354,294 households.) Another 19 percent lived in outright poverty, which means 59 percent of Miami-Dade’s population is unable to pay for some level of basic life necessities. (The Miami Herald first covered the report earlier this afternoon.)

Most worrying, the data reflects a worsening situation. Between 2015 and 2016, the county’s working-poor population increased 3 percent. Two-thirds of that jump came from people whose income exceeded the federal poverty level. But another 1 percent of the county’s top earners fell below the threshold. Overall, the number of Miamians struggling to cover basic services increased. In fact, the county’s working-poor population was just 36 percent in 2010.

United Way

As of 2016, a single Miami-Dade resident needed to earn $24,432 to cover what the United Way deemed “basic necessities” such as transportation, rent, groceries, and health care. The numbers for parents, however, are higher. A single adult with an infant needs to earn $37,692 per year. A two-adult household with school-age kids must take home $51,516 to get by. And a couple with two young children in need of child care requires a combined salary of $61,368.

Miami-Dade County’s median income is only $46,000, which means half of the county earns less than that amount. (Notably, wages have ticked up slightly in the past couple years, and the United Way’s data does not reflect that change.)

The data shows that single parents are being beaten down by the local economy: 73 percent of single fathers are either under the ALICE threshold or living in outright poverty. For single moms, that number is 83 percent. The data also confirms the economy is particularly screwing over young people: 77 percent of Miami-Dade residents under the age of 25 are living below the ALICE line (including many below the federal poverty line). Only 53 percent of Miamians aged 45 to 64 are similarly struggling. (But 70 percent of elderly residents aged 65 or older are faring poorly.)

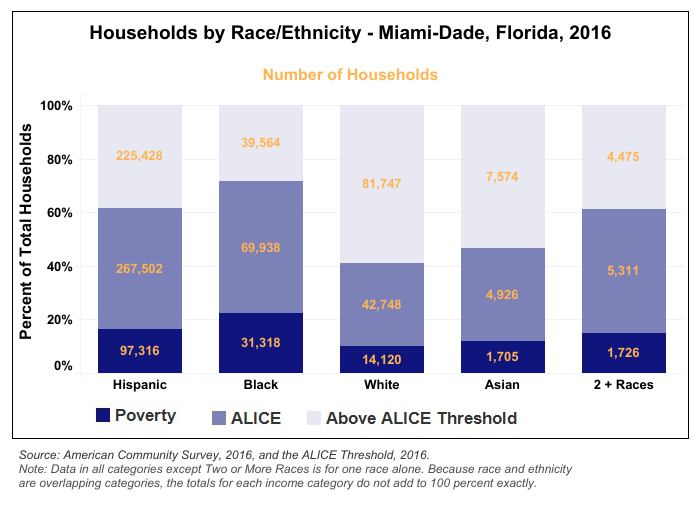

The issues are also racial. More than half of Miami-Dade’s white residents are doing fine. But the United Way says black and Hispanic residents still face “economic and legal barriers that limit their earnings and make it more likely to live below the ALICE threshold.”

United Way

Data has long warned this was the case in Miami. Rents tend to be sky-high due to the number of investors, vacationers, and foreign real-estate buyers here. But wages tend to be low, and jobs are mostly based in the service sector. As a result, some studies have warned that Miamians spend more of their salaries on rent than residents of any other U.S. city.

South Florida was also one of the areas hardest hit by the Great Recession. The United Way says the data confirms something many Miamians (and Americans in general) say they feel: that in spite of the positive employment or stock-market numbers, the nation’s “economic recovery” after the Great Recession has left low and middle earners behind.

“The general trend has been a flat recovery since 2010, the end of the Great Recession,” the United Way wrote today. “In many locations the cost of basics has increased more than wages, leading to an increase in the number of ALICE households.”

The United Way’s data meshes with other recent (and bleak) studies. According to a study released last month, 40 percent of Americans are simply one missed paycheck away from poverty.